How innovative are our banks ? - Our impressions

We were at the conference "Innovations in Banking" and share our latest insights with you

Every year, the Lucerne University of Applied Sciences and Arts organises the conference "Innovations in Banking", where banks present their current innovations & projects. But are our banks really innovative enough?

The market is currently in a state of flux, with young, fresh, adaptable Fintechs entering the market. Usually with the advantage of not having a sluggish, complex IT infrastructure behind them and a clear focus on customer orientation. On the other hand we have the big tech giants like Apple, Google, Facebook, Alibaba or Tencent, who also want a piece of the pie.

Here is a small excerpt from the presentations.

Credit Suisse - Data-Driven Marketing

Andrea Bargetzi reports how to deal with data in marketing. Not only since today content is enormously important to inspire customers. But how can the quality of content be measured and improved?

Credit Suisse has introduced a Content Health Panel for this purpose. It's a dashboard for content creators that allows them to see exactly which content is received and which is not. The performance measurement includes predefined parameters such as number of clicks, retention time, call-to-action interactions, etc. The performance of the content becomes transparent.

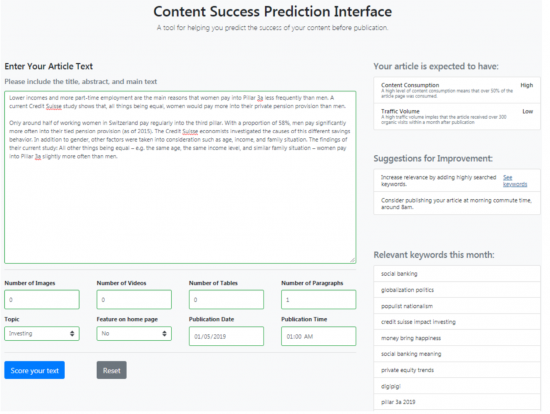

To take content to the next level, CS now works with existing data and goes in the direction of prediction. The so-called Content Success Prediction gives the author feedback before publishing on how his article will be received by the audience.

An exciting approach to how to deal with data in marketing. Here is an insight from the Content Health Panel project with ABB from 2014.

LUKB – Use Cases Data Analytics

LUKB is also making its first attempts in the field of data analytics. The following use cases, among others, are relevant for them:

- Recommendation systems: Recommendations for customers based on similar characteristics

- Customer segmentation: no longer old-school by asset class and wealth, but by behaviour & needs

- Early warning systems: The analysis can increase customer loyalty

- Potential recognition of a customer

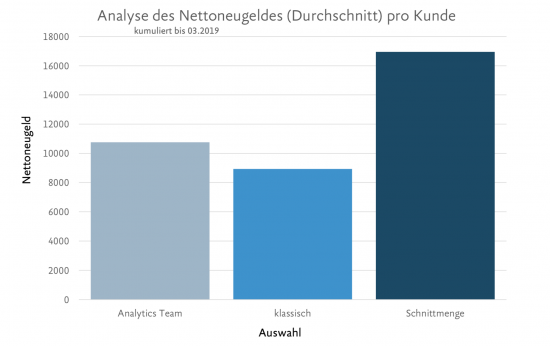

LUKB has made a first attempt at identifying potential clients with the aim of identifying third-party bank client assets. This is done by means of pattern recognition in the data, for example in transaction analysis.

Facts from the presentation by Guido Hauser:

- Refuelling behaviour correlates positively with total assets. In other words, the more you spend on refuelling, the greater the likelihood of having assets compared with little or no fuel expenditure.

- Expenditure on fines does not correlate with total assets. There is no correlation here -> I guess everyone does not like to pay fines :)

- The exhaustion of the Maestro card limit correlates positively with total assets.

If you take all these patterns together, you can easily achieve better results with Machine Learning after the test, compared to manual queries of the data by the advice centre. This also takes even more time (10 minutes with Machine Learning vs. 10 days with manual collection). Here is an insight:

UBS Atrium – Mortgage platform for institutional clients

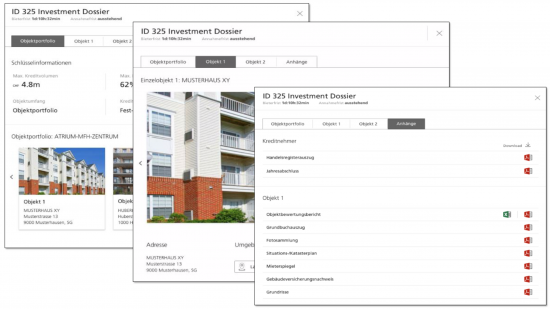

With Atrium, UBS has been operating a mortgage platform for investment properties for institutional clients for over 2 years. Markus Kuster explains how UBS has integrated the Atrium platform into its e-banking.

Institutional clients particularly appreciate the standardized investment dossiers with all attachments online and the possibility to submit a financing offer. UBS participates in the auctions and takes over the entire servicing in the case of a deal between borrower and institutional investor.

Currently, 9 out of 10 objects are financed. It is also interesting to note that with over 230 transactions carried out, only in four cases (1.7%) was the lowest price not the decisive factor for the conclusion of the transaction. This is UBS's reaction to the trend that mortgages in other markets, e.g. USA 70%, DE 40% of mortgage transactions take place via platforms and we are still lagging behind in Switzerland with 3-5%.

Credit Exchange – the ecosystem of the Swiss credit market

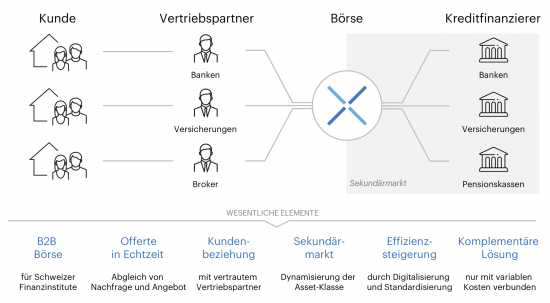

Hanspeter Ackermann talks about his vision and the plan to become the "Swiss Mortgage Exchange" with CredEx. Sales partners will be able to support customers completely independently and have access to the exchange.

In the near future, mortgages are to be classified as an asset class and can be traded transparently on the Credit Exchange. Lenders will be able to individually define the pricing by means of parameters, so that the price can be set fully automatically in seconds and a transaction can be concluded.

Valuu – the new hypoplatform on the market

Thomas Jakob gives a current insight into the launch of the Valuu App after 150 days on the market. Since its launch, Valuu has focused on owner-occupied residential property, but will now also attempt a first step in the area of investment properties. Some figures at the start:

- 270'000 visitors to the website

- 23'000 app downloads

- 2'300 registered users (with name, e-mail and mobile phone number) the offers of the partners are only displayed after registration.

- 53% of the registered users have a real case, 68% of them within the next 12 months

- 11 lenders are now involved as partners. The goal for 2019 is to establish a partner structure of 20 - 25 lenders.

After selecting a lender, Valuu checks the dossier for completeness and forwards it to the lender. As the customer has already decided on an offer, the lender benefits greatly as the financing is highly probable.

Julius Bär – Innovation in Private Banking with the JB Digital Suite

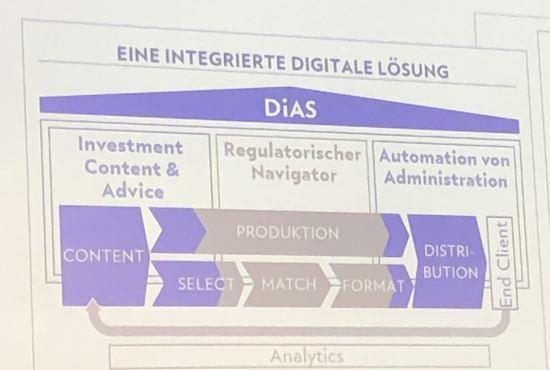

Global private banking is likely to face even more regulatory challenges than other areas of banking. The Financial Services Act (FIDLEG) with its information requirements, suitability of financial products for clients, and documentation requirements do not exactly make the job of a client advisor any easier. Moreover, private banking clients are usually globally networked and often constellations with several countries, companies, etc. have to be taken into account. To meet these requirements, Julius Baer and Peter Stampfli have developed the Digital Advisor Suite (DiAS for short).

The main focus is on a digital end-to-end advisory process, which enables individual investment content to be integrated in such a way that all content always complies with regulatory requirements.

DiAS also gives the client advisor the opportunity to make certain investment ideas attractive to the client using "investment stories". With this project, JB not only achieves the regulatory minimum, but in future will be able to make even more personal investment recommendations in the advisory area.

Raiffeisen – Application possibilities for Virtual and Augmented Reality

Finally, Stefan Jeker explains to the audience how the RaiLab is taking its first steps with virtual and augmented reality, among other things. Around 30 individual projects will be carried out in the Lab to test the business viability of such ideas.

At the center of these experiments is the user experience. The following application areas are currently central to this:

- Consulting & Services

- Qualification & Trainings

- Collaboration

- Marketing

- Human Resources

- Social & Sponsoring.

In concrete terms, virtual reality is still difficult to use in a business context. There are individual trainings, house inspections in the real estate sector etc., which have already been experienced with VR. As long as the device (the glasses) is still so hardware-heavy, it will remain a challenge.

Conclusion

In summary, there were various exciting and innovative projects and insights. The innovative strength of individual banks will be a decisive factor in determining whether new USPs can be developed in the future.

I think a first step has been taken. Most of them have recognized the development and gained first experiences. But we are still a long way from reaching our goal.

Here are two areas that will be very exciting in my view:

1. genuine customer focus

The customer is the centre of attention. Building platforms is not just about selling your own products to the right customer. It is rather about filling out the customer interface in a meaningful way. The focus must be on offering the customer real added value. This means that new, personalized services and products will be needed to solve the customers' problems. Only in this way will banks be able to offer real benefits and interact with the customer on their platform.

2. use data

Banks have a lot of data. Using this data sensibly and making it even more relevant is central to this. With the opening of certain data pools, through regulations such as PSD2, these opportunities will also be available to new market participants. AI can help to achieve improvements quickly, with few personnel and automatically.