Direct-to-Consumer at the heart of new revenue channels

Thanks to new technologies that enable continuous connections, brands can build deeper relationships with their customers.

For decades, the CPG business was built on brand and retail partnerships. In most cases, brands were not selling directly to their end customers, but through third-party retailers or wholesalers or other middlemen. But now, in a world where manufacturers are jumping direct to consumers, where startups are disrupting the market, and branding is diluted due to the media channel growth, CPG brands are pressured from all sides and fighting to be front of mind. They are required to accelerate their adoption of direct selling capabilities to gather first-party data and launch new (revenue) channels while maintaining retail partnerships.

In a traditional business model, without D2C, the brand has no relationship with their end consumers; relationships are left to retailers and wholesalers to manage and leverage. Additionally, whatever may happen on these intermediaries’ platforms, can damage the brand reputation, without the brand being aware of it.

On his side, the end consumer is totally disconnected from the brand itself, for which the bound, if any, has been built probably through traditional or digital media but not through specific D2C channels with a 2-way communication.

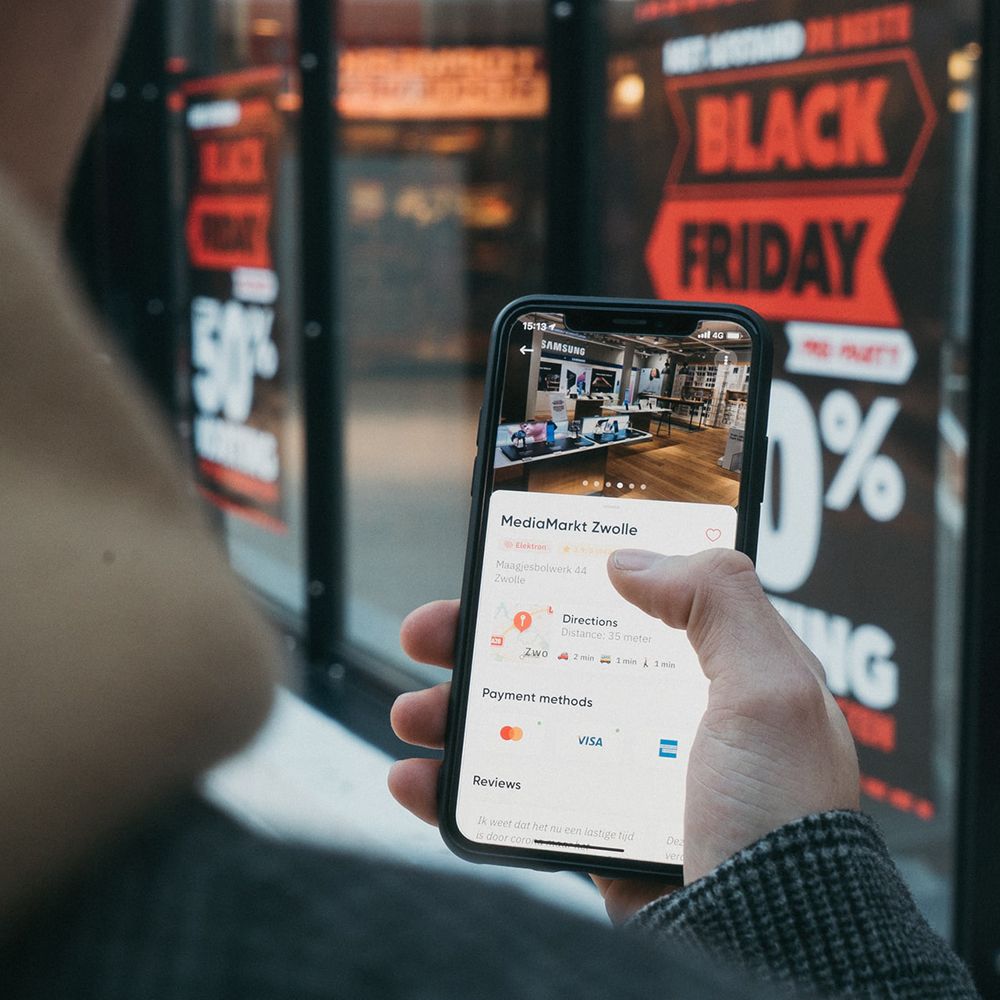

Further on, new technologies have opened the door to 24/7 relationships with customers, making it possible to address customer needs the moment they arise.

Yes, but, to achieve this 24/7 connection to their end consumers and therefore make every moment count, the path forward for a brand today must include a move towards a D2C business model.

A D2C setup may include a number of communication channels. Ideally, each of these communication channels meets the needs of the consumer, according to the very specific stage of the customer lifecycle, from engagement, to purchase, service and loyalty. Each of these communication channel opens a specific relationship to the consumer. Some established brands may have no D2C at all, whereas other brands may have a set of activated D2C channels, from 1 to many, such as a Commerce website, to address the needs of the consumer in the purchase phase of the customer lifecycle, or a customer service platform to address post-purchase needs.

The awareness phase or acquisition phase is a critical step towards building and growing your D2C relationships. This phase needs to be covered by a mix of traditional and digital, such as social, media. Indeed, how does it help to have a commerce website if nobody knows about it? This is obviously where Merkle can make a difference with our integrated agency network combining best-in-class communication and media planning services, content creation, technology, data and behavioural insights. In a saturated media market, we help brands create memorable marketing solutions to attract consumers towards activated channels, moving them from unknown to known and eventually to valued customers.

Finally, a D2C business model may not be digital-only. Brick-and-mortar stores or paper catalogues for example, may represent an important piece of the D2C strategy.

Now, let’s review what are the main drivers to engage in Direct-To-Consumer relationships.

Growing your Direct-To-Consumer relationships is becoming an imperative in a post-cookie world. If Google has delayed its plans to phase out third-party cookies, other browsers have already implemented third-party cookies blocking. In that case, developing a first-party data strategy, through Direct-To-Consumer platforms, is getting crucial. Collecting data allows for customer and product insights around shopping or buying trends. This data enables the move beyond traditional modes of customer interaction, up to offering fully automated decision support or even decision making. Obviously, trust will be at the heart of acquiring first party data. This first-party data will put brands in a position to negotiate and collaborate with retailers around merchandizing and promotions strategies. Finally, from a marketing perspective, D2C segmentation insights can be applied back into traditional marketing research.

Owning the brand experience allows to preserve the brand through UX/design and avoid brand dilution. Having a direct relationship to the customer, the brand can also provide value through new and exclusive experiences or products, while adapting the content to drive up-sell and cross-sell. More than adapting the content, it can also create new offerings that will further bound the consumer to the brand. This is critical to address competitive threads from disruptors and opens the door to diversification of offerings.

Finally, a full-funnel engagement is made possible across the whole customer lifecycle, from engagement to purchase, service and loyalty, which opens up new opportunities for growth, focusing on the acquisition of high-value customers.

All this is made possible thanks to the Salesforce Customer 360 Platform. The Customer 360 platform and its set of cloud solutions, allows brands to activate the right channel at the right time across the entire customer lifecycle. To foster engagement, Marketing Cloud or Community Cloud are the two channels brands you may want to activate. By entering the purchase phase, Commerce Cloud, for B2C or B2B, you will enable online shopping. Service Cloud will facilitate communications with customers in the after-sales phase and Loyalty Cloud will ensure customer retention.

In such a disrupted market, both innovation and creativity will help you remain competitive.

To support brands in executing on their D2C initiatives, Merkle have built a D2C playbook. Our Playbook begins with a total assessment to establish channel readiness and extends through D2C development and implementation. Customize your brand experience and optimize D2C growth with increased insight into customer behaviors, habits, and progression towards a preference for online purchasing. Increase conversions through data-driven marketing strategies and technology investments to identify critical moments of truth. Our actionable insights leave you ready to launch your D2C roadmap, including multi-channel technology, personnel, and process recommendations.